Estate Planning as a step by step process (not fill in the blanks)

A new year is here, which motivates many families to either revisit their existing Estate Plans or to explore this process for the first time. Whether it is your first time or your third time pondering questions of who you trust to carry out your wishes and what those wishes are, it is vital that the attorney you work with takes the time to understand your goals and guides you through the process. You should both understand your options and how your Estate Plan functions before finalizing it.

My firm belief is that being an Estate Planning attorney requires providing a full service, not just an end product. It is vital that each family has peace of mind through a process where their questions are answered (even the questions they didn’t think to ask), their wishes are addressed comprehensively, and they understand how to fund their Trust so that probate is effectively bypassed. Unfortunately, I have had many clients who previously interviewed other attorneys or set up Estate Plans with other firms that did not provide a thorough process.

Last year, I had several clients who had worked with other attorneys only a few months prior to contacting me; they felt that the previous attorney just used a “fill in the blank” method, didn’t give them guidance of different options, and didn’t explain how their Estate Plan worked. It feels awful that these families had to pay for Estate Planning twice in such a short span of time, but I am grateful that they knew they prioritized the process when they worked with me. With all of these families, we worked through our step by step process to reach a well thought out Estate Plan that fit their unique family dynamics. These families, like my other clients, also left feeling comfortable to reach out to me when they had questions about funding the Trust afterwards.

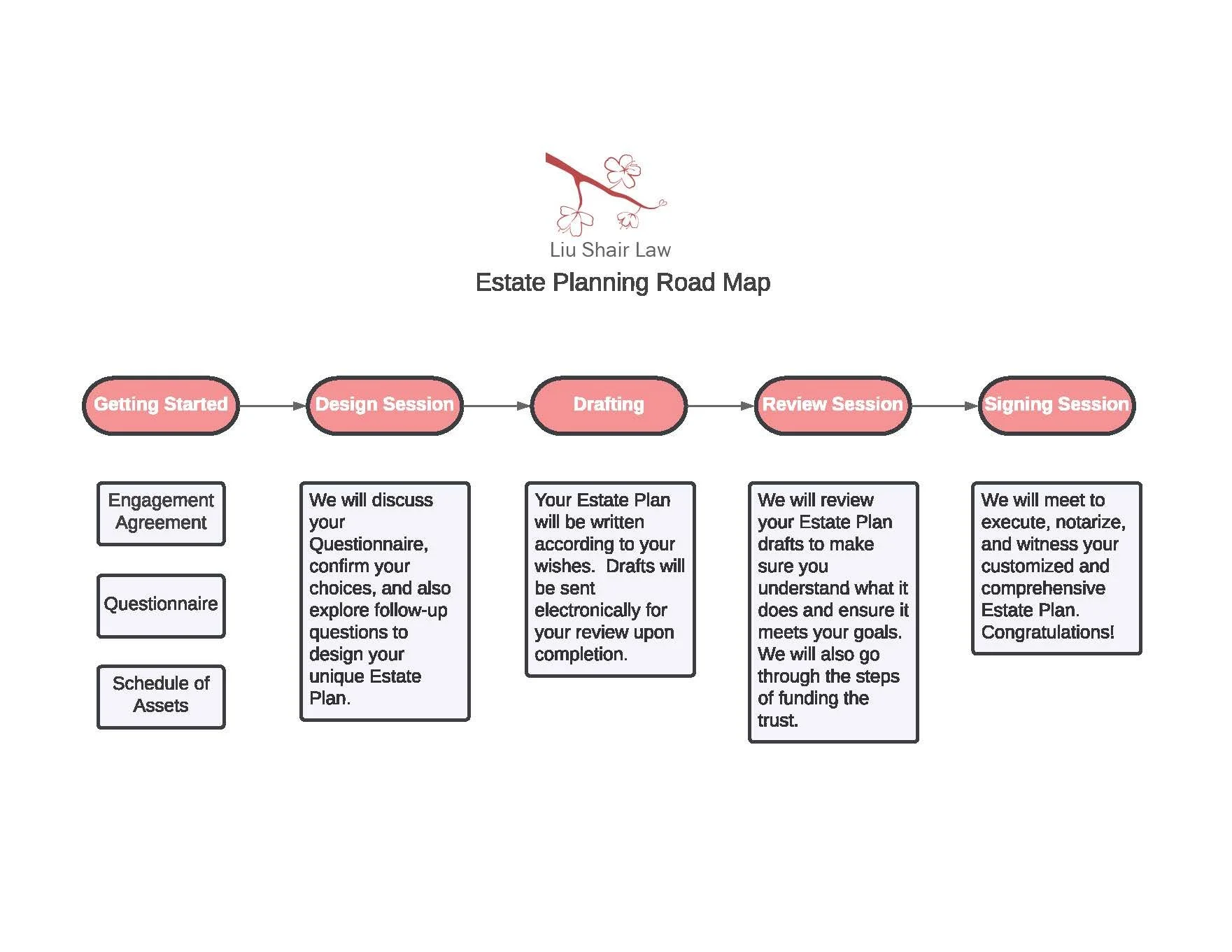

A graphic of our typical Estate Planning process is shown at the top of this blog post. We explain these steps to every potential client when they have a phone or Zoom consultation. I find it helpful to discuss each phase so that potential clients understand that we take the process seriously and it may take some time to complete. The typical timeline for us is roughly two months from start to finish, though it can vary greatly if families are in a busy season and need extra time to schedule appointments or to finalize their choices on very personal topics like asset distribution schedules, thoughts in the disaster scenario, or healthcare wishes. This may require more communication with me to understand or brainstorm different options.

Getting Started

When we first get started with clients after a consultation, we want to make sure they are ready to commit the time to moving through this process and to making key decisions. This requires giving thought to whom they would trust to make decisions or take responsibility in their absence/incapacity and preliminarily how they would want to distribute their assets. We also ask every family to list out where their assets are located for two purposes: 1) with this information, we can advise how to fund the Trust because different types of accounts and even different financial institutions may have different protocol for how best to handle this and 2) keeping an updated list is very important for the person you trust to handle finances to be able to track down the assets they would need to manage. Gathering this information may take some time for families, but we find that it is very important to have collected.

Design

The next phase is the meat of our process of ensuring that each client’s Estate Plan comprehensively addresses their family’s goals. We hold a Design session meeting to discuss the Questionnaire and Schedule of Assets, as well as many follow up questions to design how the Estate Plan will operate. These questions include initial wishes, contingency plans, timelines for different types of distributions, when you would trust your nominees to get involved, and what you would want them to be aware of in different health care situations if you cannot decide for yourself.

The lack of any personalized design tends to be the biggest concern for clients who came to work with me after they were dissatisfied with their previous Estate Planning attorney. These clients will often remark that they didn’t know the scope of their different choices because the previous process was very basic.

Drafting

Sometimes the Design session meeting is sufficient to address all of the different elements that we need to draft a thorough Estate Plan. If it isn’t, then we stay in touch with clients while they are finalizing their wishes. They may just need a little time to discuss amongst themselves or they may want to ask more questions later on. When we have all of the wishes determined, then we can work on the next phase of drafting the Estate Plan accordingly.

This process can require several weeks as we write the first draft, review it, and then polish things before sending the drafts as PDF files to clients to review. Drafting requires including all of the legal language that applies in California. With a diligent attorney, drafting also includes thoughtful customized language for each family’s unique wishes. We want to set up Estate Plans that will be complete and clear for their nominees to follow when the time comes so that court interference is not an issue and the client’s wishes are carried out.

Review Session

As mentioned previously, we send our clients drafts of the Estate Planning documents. Estate Plans consist of many different components (e.g. Revocable Living Trust, Will, Financial Powers of Attorney, Health Care Directives, Trust Transfer Deeds for real property being put into the Trust, and other legal documentation), which get very long. Some clients meticulously read each page and other clients get overwhelmed by all of the pages that are sent to them. We believe that it is crucial each client understands how their Estate Plan works before they sign and execute it. Consequently, we offer a Draft Review session prior to meeting to sign everything.

The Draft Review session is a time where we discuss each document one by one to talk about the purpose of each one and how each one functions. It is also a time when clients can ask questions to ensure they understand what their Estate Plan does. There are sections that intentionally need to consist of legal jargon; we can talk about what these words mean and why we need to include them. Throughout the process, we also go through the steps for funding the Trust (based on each client’s specific assets/accounts); we do this several times so that clients can continue to ask questions and can make sure they understand what they need to do with each financial institution. We try our best to emphasize the great importance of funding the Trust with current assets and future assets.

Signing Meeting

When we all are feeling confident and comfortable with the Estate Plan, it’s time to sign it! Typically, this means coming to my office and going through each document, signing each one, and notarizing (or witnessing, in the case of a Will). If an Estate Plan is not executed correctly, there can be issues with administering; it is crucial that this step is done thoroughly. In this digital age, when clients come to the office to sign, we also make scanned versions of each signed document. This way, families retain both the original version of the Estate Plan, but also have a digital record that they can store. We also hold onto the scanned copies as well.

After everything is signed and done, we hope that clients will get back in touch if they have questions when funding the Trust or if there are updates that need to be made (e.g. if their wishes change as to asset distribution, nominee selection, or other goals). We keep in touch annually through an online newsletter that outlines any developments in relevant laws, how we’re doing, and also reminds clients to keep their Trust funded.